Hydrogen is emerging as a key player in the future sustainable energy system, offering a clean and versatile alternative to traditional fossil fuels. Northern Europe is actively pursuing hydrogen production, particularly hydrogen generated from renewable energy via electrolysis (“green hydrogen”), as part of the region’s ambitious goals to transition to a sustainable and climate-neutral economy. These efforts are supported by national hydrogen strategies and roadmaps that outline targets for hydrogen production, electrolyzer capacity, and investment in research and innovation. However, hydrogen is still a very emergent technology, and subject to a lot of uncertainty that makes long-term policy and investment planning difficult.

In addition to HYDROGENi, SINTEF also coordinates research projects like the H2Accelerate TRUCKS initiative and the Hy4GET project, which are contributing to the establishment of a robust hydrogen economy in both Europe and Norway.

When considering the emerging hydrogen economy, it is important to remember that production is not the only area of opportunity for countries in Northern Europe, nor do they have to be limited to being involved in solely one part of the value chain. For example, there is a case to be made that Norway not necessarily take on the role of hydrogen producer, but of developer of the technology for hydrogen production (upstream the value chain) or guarantor of its end use (downstream the value chain).

To investigate the optimal hydrogen value chains, the Operations Research and Economics (ORE) group at SINTEF has adapted the Bioresource and Recycling Optimisation Model (BROMo) to analyse clean hydrogen value chains in Norway and the surrounding northern European area. This work was conducted as part of FME HYDROGENi’s Integrating Activity.

Previously, BROMo has been applied in techno-economic, cross-cutting value chain analyses for circular economics (as in the TREASoURcE project), and bioresource utilisation (as in the SUSFEED project). However, its modelling paradigm enables its use in other, hydrogen-relevant sectors like transport, chemicals, equipment.

Unlike other (very relevant) studies of hydrogen as a component of the energy system, BROMo aims to establish hydrogen’s position as a commodity in a variety of industrial value chains, including energy, transport, and manufacturing. This should enable us to demonstrate optimal solutions for interconnected hydrogen value chains in Norway and Northern Europe, under different policies and technology development scenarios.

In 2024, the ORE group carried out a “proof of concept” preliminary study, using a simplified network of European countries (Norway, Denmark, Sweden, Germany, France, the Netherlands, and the UK), and focusing only on available data for green hydrogen supply and demand. First, we considered a scenario with no limits on the amount of hydrogen transported between countries via pipeline. We then considered a second scenario with a set limit on hydrogen transported. However, it’s important to note that the focus in the second scenario was on the model’s response, rather than setting realistic limits on transmission.

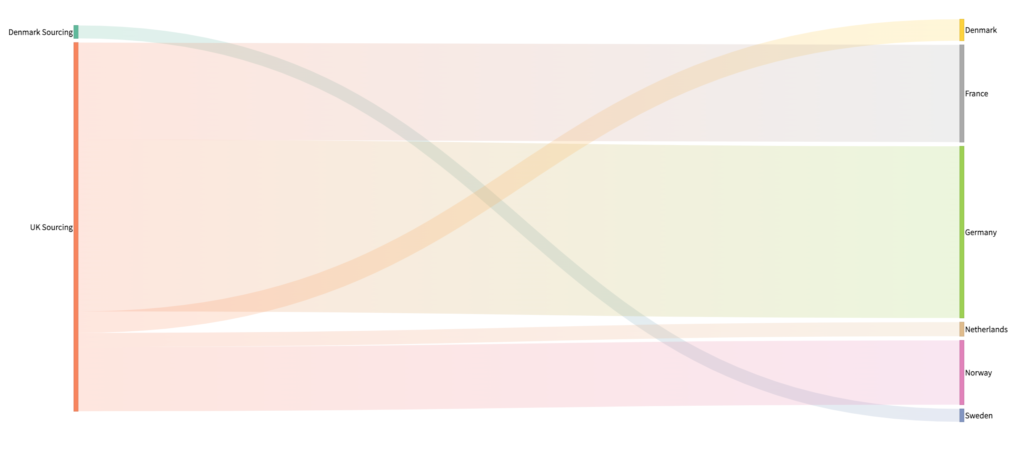

These initial results already indicate the potential of the application of models like BROMo for modelling the hydrogen landscape in Europe. In the scenario with no limits on pipeline capacity, Germany emerges as the dominant hydrogen producer, supplying most of Europe.

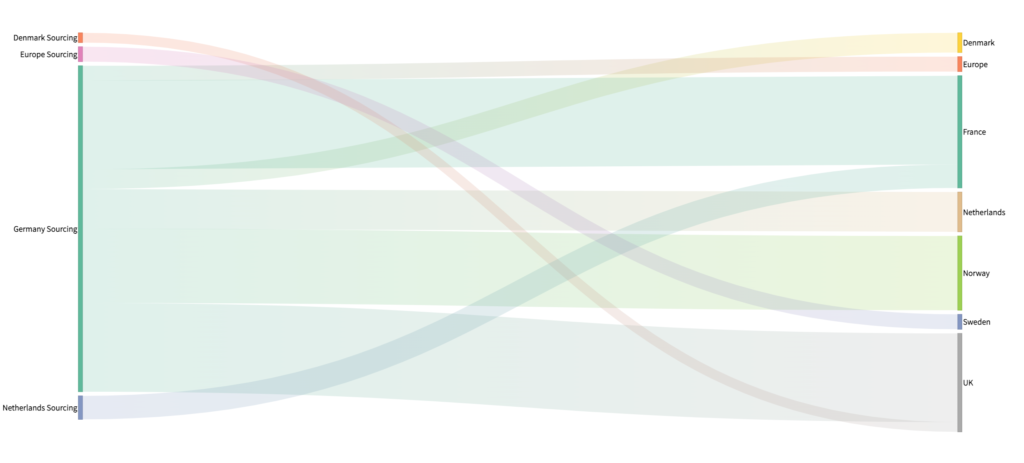

However, when pipeline capacity limits are introduced, the model shows a more distributed production landscape, with other countries, including Denmark, Germany and the Netherlands, playing a significant role in hydrogen production.

Results from this model have the potential to provide deeper insights into how different industrial sectors react to changes in the hydrogen landscape, and how different industrial clusters involving hydrogen can develop in each country.

The next step is to run a more comprehensive analysis using BROMo that incorporates more hydrogen production pathways, including blue hydrogen from steam methane reforming with carbon capture, as well as ammonia production. The ORE group will also refine BROMo to incorporate other hydrogen-specific elements, such as hydrogen as a fuel source, transport capacity, and market price dynamics.

However, while BROMo can model non-linear changes in industries and markets, better data is needed for more accurate modelling of hydrogen production systems. This includes large-scale production systems, regionalised demand and investment costs.

Our hope is that by value chain modelling tools like BROMo can facilitate the planning of optimal hydrogen value chains, depending on hydrogen’s role in a particular industry, the production method, country’s expertise, etc. This knowledge will expediate the uptake of clean hydrogen in society and, by extension, support our transition to a future, net-zero society.

More information on these preliminary results can be found in the project memo, “Logistics of the Hydrogen Industry in Northern Europe”.